Google Pay, or GPay, announced new UPI payment features at the Global Fintech Festival 2024. These include UPI Circle, UPI Vouchers, eRupi, prepaid utility payments, and more. The app has also introduced support for AutoPay in UPI Lite. Here’s everything you need to know about the new Google Pay UPI features.

Google Pay New Features For UPI Payments

Google Pay is the second-largest payment app in India, just behind PhonePe. It’s an important platform that serves the world’s largest real-time digital payments ecosystem: UPI. Here are the new features announced by GPay in collaboration with the National Payments Corporation of India (NPCI).

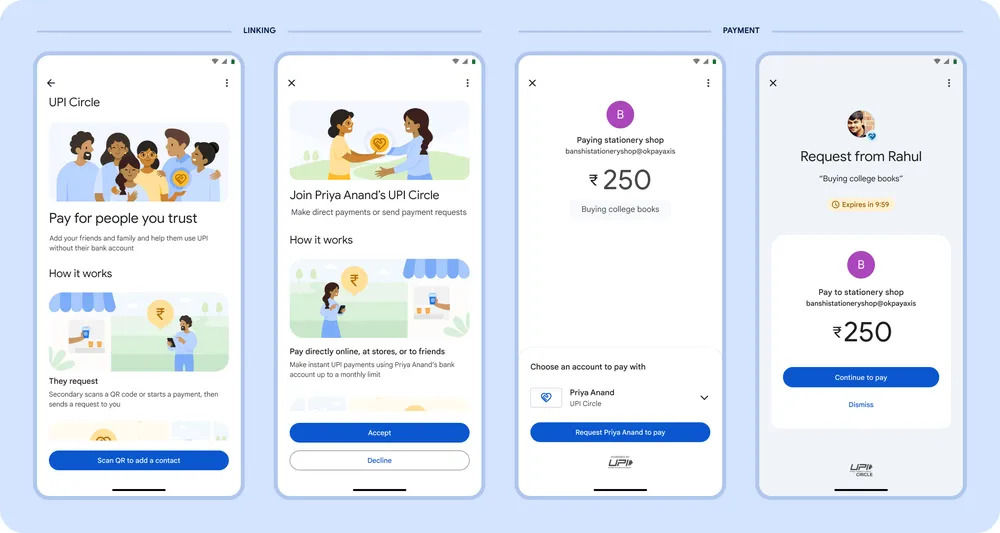

1. UPI Circle

UPI Circle is a part of the new delegate payments service that was recently approved by the NPCI and RBI. It allows users to add secondary users to their UPI account and make payments from the primary user’s bank account. The feature will work in two ways,

- Partial Delegation: The primary account holder will manually approve each payment request.

- Full delegation: Primary account holders can assign a limit of up to Rs 15,000, after which secondary users can make UPI payments without approval.

The UPI Circle feature will benefit parents by encouraging their children to adopt UPI payments under full supervision. It will also be helpful in the civil world, where contractors can assign certain sub-limits to their workers for faster payment processing. UPI Circle has endless applications.

2. UPI Vouchers or eRupi

UPI voucher is a prepaid limit that can be assigned to a user’s phone number, even without linking a bank account. For example, the sender can pay Rs 250 for a UPI voucher linked to the receiver’s registered phone number. The receiver can use that UPI voucher to make any UPI payments, even if they do not have a bank account linked to that number.

UPI Vouchers are also called eRupi (not to be confused with the e-Rupee, a blockchain-based payment system for the Indian Rupee). This new UPI voucher feature will be helpful for people who want to receive payments on a secondary phone number for privacy but don’t have a bank account linked to that number.

3. Clickpay QR Scan for Bill Payments

Google Pay has introduced support for Clickpay QR codes, where businesses can generate customised QR codes on a bill. For example, your electricity supplier can now generate a special QR code on your monthly bill, which you can directly scan using the default scanner in the GPay app. You can complete your payment using UPI through your linked bank account.

This feature eliminates the need to enter the biller’s details in the Gpay app manually. The customised QR codes on the bills can be scanned using any UPI app. However, the implementation of Clickpay QR Scan requires active participation from the business owner.

4. Prepaid Utility Payments

Google Pay has collaborated with Bharat Billpay (BBPS) to introduce prepaid utility payments. Users can now pay their monthly bills, such as society maintenance, electricity, broadband, etc., in advance using UPI, even before the business generates the bill.

This feature will help users complete their monthly payments on time, even if the respective business delays bill generation. However, the feature is currently limited to a small set of service providers, and GPay is working to onboard more businesses on the app.

5. Tap and Pay with Rupay Cards

Google Pay has finally introduced support for Tap and Pay payments on Rupay credit and debit cards. Previously, this feature was limited to VISA and Mastercard cards. Users with an NFC-enabled Android phone can link their Rupay cards to the GPay app and make NFC payments on POS machines without carrying their physical cards.

6. Autopay for UPI Lite

UPI Lite was introduced in 2022 for small payments of up to Rs 500. It was designed to reduce the strain on bank servers and prevent the clutter of daily payments in bank account statements. However, UPI Lite required users to add balance to their wallets manually.

GPay and NPCI have now introduced Autopay on UPI Lite. Users can now set up mandates using UPI Lite to make automated top-ups to their UPI Lite wallet. GPay users no longer need to worry about running low on their UPI Lite balance.

The new UPI payment features in GPay have started rolling out to users in India. However, some features are expected to be available by December. We recommend users update their Gpay app to the latest version to access these new features.

The post Google Pay Introduces New UPI Payment Features in India appeared first on MySmartPrice.